Wskaźnik Nexus

Kluczowym etapem przy obliczaniu wartości ulgi IP Box jest określenie poziomu wskaźnika NEXUS.Wskaźnik NEXUS jest mnożnikiem korekcyjnym, każdorazowo wyliczanym w oparciu o poniesione koszty związane

Jesteś właścicielem patentu lub programu komputerowego chronionego prawem autorskim?Wytworzyłeś je, rozwinąłeś lub ulepszyłeś w ramach prowadzenia własnej działalności B+R? Jeśli tak, możesz skorzystać z bardzo atrakcyjnego rozwiązania podatkowego – ulgi IP Box.

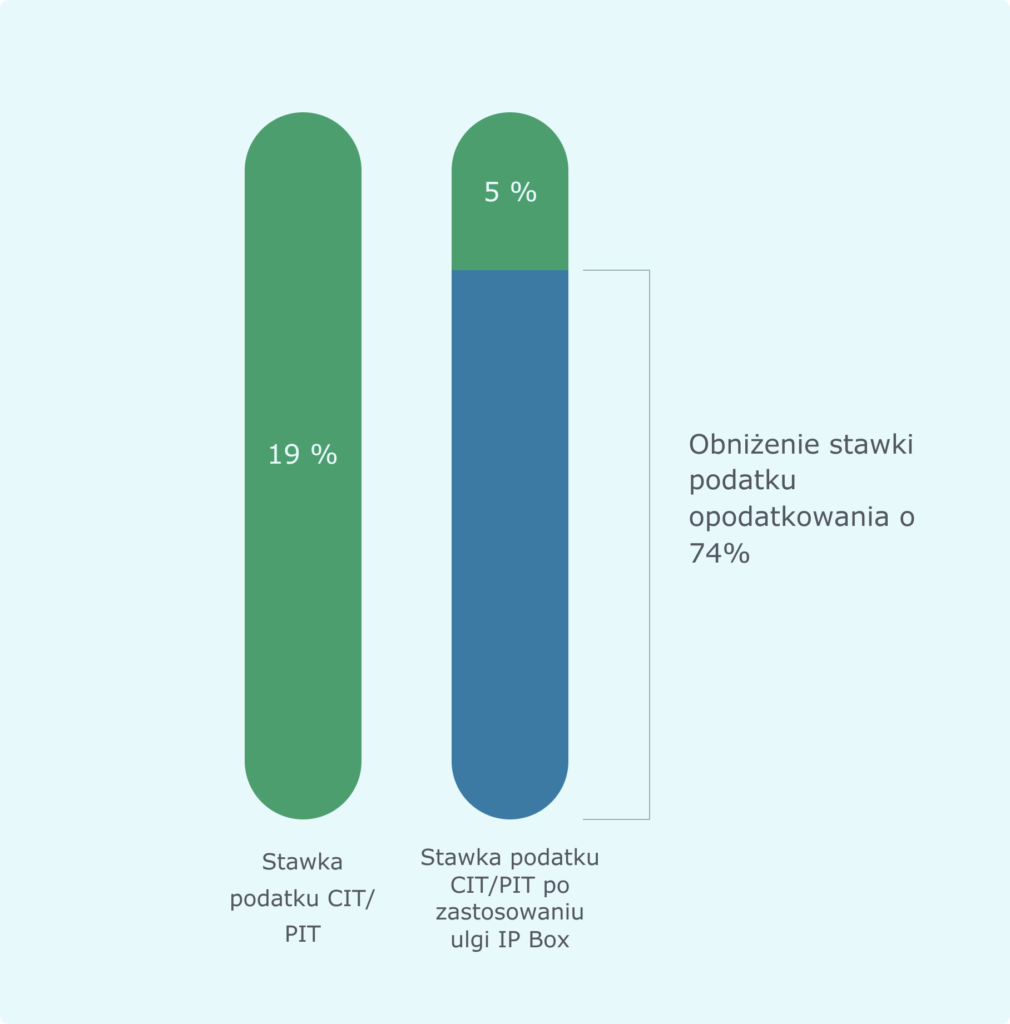

IP Box to ulga podatkowa, która umożliwia przedsiębiorstwu obniżenie stawki podatku CIT/PIT do 5% dla dochodu kwalifikowanego z komercjalizacji kwalifikowanych praw własności intelektualnej (IP).

Pomagamy w identyfikacji kwalifikowanych IP oraz wspieramy w prowadzeniu prawidłowej ewidencji na potrzeby IP Box

Przeprowadzamy audyt posiadanej dokumentacji oraz dostosowujemy ją do wymogów ulgi IP Box

Przeprowadzamy odpowiednią kwalifikację dochodów i podział kosztów na potrzeby skorzystania z opodatkowania w ramach IP BOX

Zabezpieczamy prawo do skorzystania z ulgi do IP Box poprzez uzyskanie interpretacji indywidualnej oraz przygotowujemy formularz CIT/PIT IP

Jesteśmy obecni na każdym etapie procesu, również na etapie czynności sprawdzających czy kontroli

Dzięki algorytmom sztucznej inteligencji, MoneyOak oferuje Ci możliwość bezpłatnego oszacowania poziomu oszczędności dla Twojej firmy.

Kluczowym etapem przy obliczaniu wartości ulgi IP Box jest określenie poziomu wskaźnika NEXUS.Wskaźnik NEXUS jest mnożnikiem korekcyjnym, każdorazowo wyliczanym w oparciu o poniesione koszty związane

Proces kalkulacji ulgi IP Box można podzielić na 3 etapy: 1. Obliczenie dochodu z praw własności intelektualnej W tym celu należy obliczyć wysokość dochodu, który

Z ulgi IP Box może skorzystać przedsiębiorstwo, które wytworzyło, rozwinęło lub ulepszyło w ramach prowadzonej przez siebie działalności B+R następujące rodzaje praw własności intelektualnej: Patent

MoneyOak pomaga poprawić wynik finansowy Twojej firmy, kiedy Ty koncentrujesz się na swoim biznesie.

ul. Rejtana 17/30

02-516 Warszawa

+48 22 103 19 28

hello@moneyoak.pl

Dzięki algorytmom sztucznej inteligencji, MoneyOak oferuje Ci możliwość bezpłatnego oszacowania poziomu oszczędności dla Twojej firmy.

Ta strona korzysta z ciasteczek, aby zapewnić Ci najlepszą możliwą obsługę. Informacje o ciasteczkach są przechowywane w przeglądarce i wykonują funkcje takie jak rozpoznawanie Cię po powrocie na naszą stronę internetową i pomaganie naszemu zespołowi w zrozumieniu, które sekcje witryny są dla Ciebie najbardziej interesujące i przydatne.

Niezbędne ciasteczka powinny być zawsze włączone, abyśmy mogli zapisać twoje preferencje dotyczące ustawień ciasteczek.

Jeśli wyłączysz to ciasteczko, nie będziemy mogli zapisać twoich preferencji. Oznacza to, że za każdym razem, gdy odwiedzasz tę stronę, musisz ponownie włączyć lub wyłączyć ciasteczka.